In the fast-paced and ever-evolving world of technology, startups have become the driving force behind innovation. Yet, one of the biggest hurdles tech entrepreneurs face is securing the funding needed to turn their ideas into reality. In this guide, we delve into the essentials of tech startup funding, offering insights and actionable strategies to help you secure investments and take your startup to the next level.

Understanding Tech Startup Funding

Tech startup funding refers to the capital raised to support the growth and operations of a technology-based business. This funding typically occurs in stages, each corresponding to a specific phase of the startup’s growth. The most common stages include:

Seed Funding: The initial capital used to develop a proof of concept or prototype.

Series A, B, and Beyond: Larger funding rounds aimed at scaling operations, expanding market reach, and achieving profitability.

Securing tech startup funding is often challenging due to high competition, market uncertainties, and the inherent risks associated with startups. However, with proper planning and execution, these hurdles can be overcome.

Related Article:

Launch Your Startup with 8 Actionable Tips for Success

Preparing Your Tech Startup for Funding

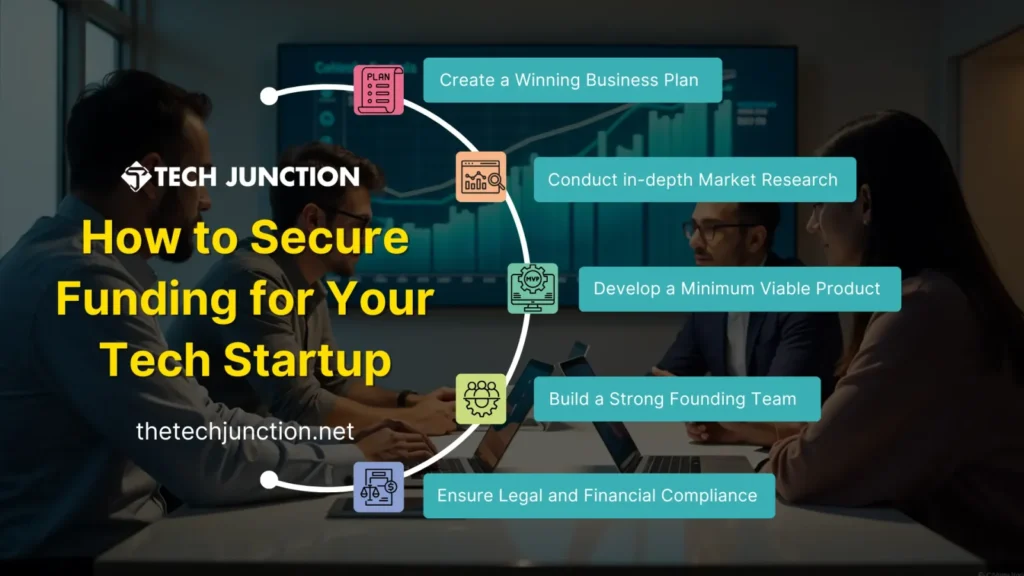

Before approaching investors, it’s crucial to ensure your tech startup is ready to attract their attention. Preparation involves several key steps:

1. Craft a Compelling Business Plan Your business plan is the blueprint of your startup. It should clearly outline:

2. Market Research: Showcase a deep understanding of your target market and competitors.

3. Unique Value Proposition (UVP): Highlight what sets your product or service apart.

4. Build a Minimum Viable Product (MVP): An MVP demonstrates your idea’s feasibility and market potential. It serves as a tangible proof of concept that investors can evaluate.

5. Establish a Strong Founding Team: Investors often prioritize the team behind the idea. Ensure your team has a diverse mix of skills, experience, and commitment.

6. Ensure Legal and Financial Compliance: Have your financial records in order, and ensure you’ve addressed any legal requirements to avoid red flags during due diligence.

Types of Tech Startup Funding Options

Understanding your new business funding options is essential to choose the one that best suits the needs of your tech startup:

Bootstrapping: Self-funding your startup using personal savings or revenue generated by the business. While this provides full control, it may limit growth potential.

Angel Investors: High-net-worth individuals who invest in early-stage startups in exchange for equity. They often provide mentorship alongside capital.

Venture Capital (VC): VC firms invest in high-growth startups with significant market potential. While they bring substantial funding and expertise, they also demand equity and decision-making power.

Crowdfunding: Platforms like Kickstarter and Indiegogo allow startups to raise funds from a large pool of backers. This option is particularly effective for consumer-focused products.

Government Grants and Subsidies: Many governments offer financial assistance programs to support tech innovation. Research available options in your region.

Crafting a Winning Pitch Deck

Your pitch is your chance to convince investors of your startup’s potential. To craft a winning pitch:

1. Focus on Key Components

Problem: Clearly define the issue your product solves.

Solution: Explain how your product addresses this problem.

Market: Highlight your target audience and market size.

Team: Showcase the skills and experience of your team.

2. Use Storytelling: Connect emotionally with investors by telling a story that underscores the impact of your product.

3. Highlight Traction and Growth Potential: Provide data and metrics that demonstrate progress, such as user adoption, revenue growth, or partnerships.

4. Prepare a Professional Pitch Deck: A well-designed pitch deck should include your business model, financial projections, and go-to-market strategy. Keep it concise and visually appealing.

Finding the Right Investors

Not all investors are created equal. Finding the right match for your startup is crucial:

Research Potential Investors Identify investors who specialize in your industry or stage of growth. Look for individuals or firms with a track record of supporting similar ventures.

Network Effectively Attend industry events, join startup accelerators, and leverage platforms like LinkedIn to connect with potential investors.

Build Relationships Cultivate relationships with investors before formally seeking funding. Regular updates and genuine conversations can pave the way for future investments.

Trends and Insights in Tech Startup Funding

Staying informed about industry trends can give you a competitive edge:

Emerging Technologies: Areas like AI, blockchain, and green tech are attracting significant investor interest.

Geographic Trends: Regions like Silicon Valley, Bengaluru, and Shenzhen continue to dominate tech investments, but emerging ecosystems are gaining traction.

Diversity in Funding Sources: Non-traditional funding options, such as revenue-based financing, are becoming increasingly popular.

Post-Funding Strategies for Success

Securing funding is only the beginning. Post-funding, focus on:

Efficiently Managing Capital: Create a budget strategically allocating funds across operations, marketing, and product development.

Setting Milestones: Work towards clear, achievable goals to demonstrate progress to investors and stakeholders.

Maintaining Transparency: Keep investors informed with regular updates on financial performance and operational milestones.

Preparing for Future Funding Rounds: Use the initial capital to achieve significant milestones, making your startup more attractive for subsequent funding rounds.

Conclusion

Securing tech startup funding is a multifaceted journey that requires preparation, persistence, and strategic execution. By understanding the funding landscape, crafting a compelling pitch deck, and finding the right investors, you can set your tech startup on the path to success. Remember, each funding milestone brings you closer to achieving your vision—start planning your funding journey today!

FAQs

1. What are the most common sources of tech startup funding?

Angel investors, venture capital firms, crowdfunding platforms, and government grants are popular sources.

2. How do I know if my startup is ready for funding?

Ensure you have a solid business plan, an MVP, and a committed team before seeking funding.

3. What is the average timeline for securing funding?

Depending on the stage and type of funding, it can take anywhere from a few months to over a year.

The Tech Junction is the ultimate hub for all things technology. Whether you’re a tech enthusiast or simply curious about the ever-evolving world of technology, this is your go-to portal.